Discover how to Take Advantage of New Opportunities whilst Managing your Costs with Effective Financial Services

Banking and other financial services play a strategic role for enabling business operations and growth in every single company.

Financial services is quite a complex cost category, with banks in the position of long term trusted partners. But in order to attain truly optimal conditions to meet your short and long term goals, insider knowledge of the banking sector is essential, but mostly not available.

Many companies struggle to get full transparency on their financial service costs, and with optimizing their financial performance. Our banking experts focus exclusively on financial services, which in fact encompasses only one of many (time consuming) tasks of a CFO, together with accounting, taxing, reporting, audit, controlling, etc.

The international finance experts of Expense Reduction Analysts accumulated deep insights from within the financial industry over many years. They are familiar with the internal operations of banks, what new regulations are on the horizon, how risk management is best set up, etc. It is their insights which have created our dedicated white paper.

Protect the Future Success of your Business

Download our white paper and discover crucial components for achieving success within financial services.

Download the full white paper instantly

Voer uw e-mailadres in

"Banking and other financial services play a strategic role for enabling business operations and growth in every single company."

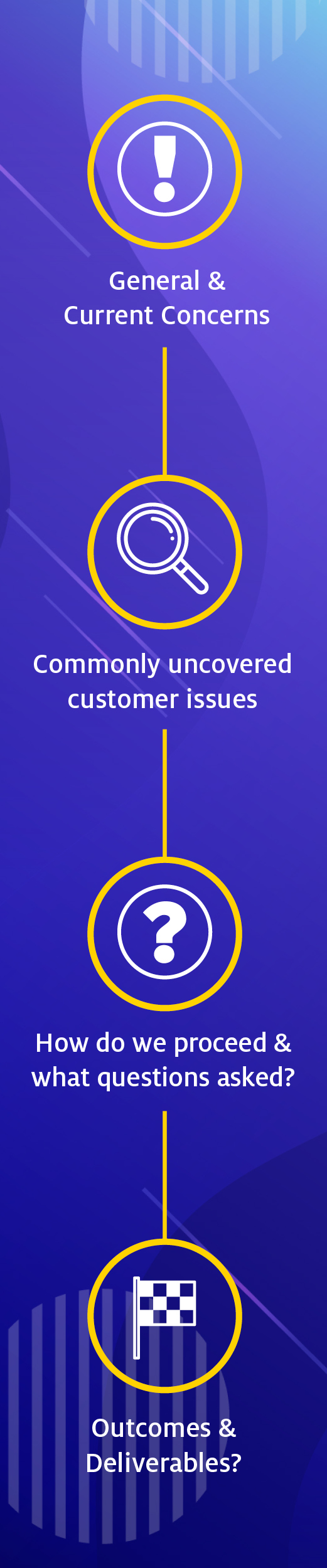

Crucial Areas We Explore

Treasury & Cash Management

The main purpose of Treasury & Cash Management is to optimize the company’s liquidity position and to reduce financial and operational risks. At ERA we ensure that not only risks are reduced but also the liquidity position is maintained at lowest cost. We leave no stone unturned to achieve the highest performance in Treasury & Cash Management.

Trade Finance

Well over 80% of all global trade is reliant on trade finance. Consequently, trade finance is important for sustaining the growth of your company. There is a broad offer in trade finance services and products, each having a different cost and risk impact. At ERA we leverage our knowledge and insights to check whether your company’s trade finance policy returns the best value for money. There often is a strong interaction with Foreign Exchange Management and the costs and risks involved with foreign currencies can be deal breaking for many trade finance transactions.

Financing

Financing is crucial for any business activity. It’s not only important how to structure your current finance and collateral position but also to look ahead to future endeavors. In-depth industry knowledge is key to create sufficient working capital, implementing banking and non-banking solutions and negotiate and optimize collateral positions. Understanding how banks operate internally and have insights on alternative finance methods is essential in optimizing current and future finance structures and securing the growth of your company.

Download our full white paper today, which explores tangible actions you can take in relation to these topics in order to generate value.

Key Insights we Explore inside our Financial Services White Paper

But in order to attain truly optimal conditions to meet your short and long term goals, insider knowledge of the banking sector is essential, but mostly not available.